THE MANY LIVES OF GOLDMAN SACHS: HOW THE LATEST BILLION DOLLAR SCAM IS THE LATEST IN A HISTORY OF CONTROVERSIES

In the 152 years since its inception, Goldman Sachs had operated in financial dealings across the globe, which had seen the powerful Wall Street investment bank skirt the gray areas along the corporate world's shady alleys.

For the first time in its history, Goldman had admitted to criminal wrongdoing in a New York Federal Court in October 2020, when it was caught with its hand in the cookie jar in the scam that involved the Malaysian government’s development fund called 1malaysia Development Berhad or “1MDB,” as it’s popularly known.

U.S Department of Justice officials charged the financial giant with underwriting the bonds in the scam that diverted funds designed to help economic development and was instead used to pay bribes.

“According to Goldman’s admissions and court documents, between approximately 2009 and 2014, Goldman conspired with others to violate the FCPA by engaging in a scheme to pay more than $1.6 billion in bribes, directly and indirectly, to foreign officials in Malaysia and Abu Dhabi in order to obtain and retain business for Goldman from 1MDB,’ federal officials wrote in a news release in October discussing the settlement.

In the aftermath of the scandal, Goldman Sachs was left with more than a $5 billion penalty price tag.

According to CNN, the bank settled with the Malaysian government to pay $3.9 billion in exchange for criminal charges against its Malaysian subsidiary and its directors to be dropped. An additional $2.9 billion will also be paid to various authorities, of which $1.3 billion of that amount will be paid to the U.S. Justice Department.

Per the settlement, a subsidiary of Goldman Sachs pleaded guilty in the case to which officials agreed to deferred prosecution. Meaning, if the company holds up its end of the deal, the government will not continue its criminal investigation.

The settlement was the largest penalty under the Foreign Corrupt Practices Act, which had been passed by the U.S. Congress to act as a deterrent against bribing foreign leaders.

The entire scandal, which is now a stain on the powerful bank, was an inevitable train wreck waiting to happen.

THE 1MDB SCAM

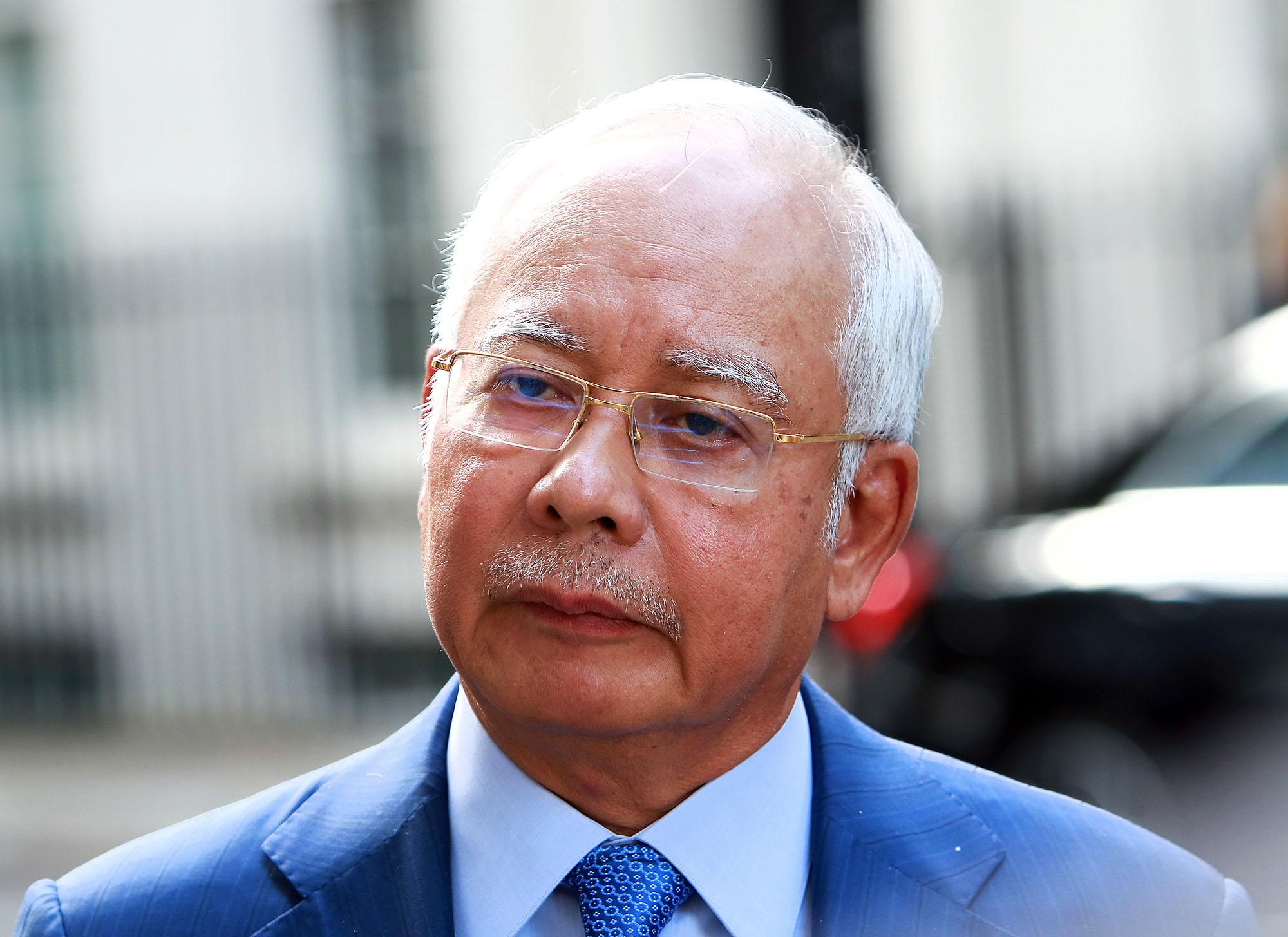

Just like most wrecks, the drivers are oblivious to the plight of the innocent causalities such as the Malaysian government and its people. Smack in the middle of the scandal is the former Malaysian Prime Minister, Najib Razak, who created the fund eleven years ago. A descendant of a political aristocracy and the son of Abdul Razak, Malaysia’s second prime minister.

He created the fund to manage the wealth of the sovereign state and raise funds by bond offerings to develop the nation. Goldman hauled in $6.5 billion from investors, which Najib, his family, and cronies looted on an astronomical level, officials said.

The scandal was made public and had caused his party a humiliating defeat. Najib was later arrested, charged, and convicted for money laundering, breach of trust, and abuse of power. He was sentenced to 12 years in prison, according to media reports. However, the sentence was suspended while appealing the judgment.

Former Malaysia Prime Minister Najib Razak

The fund was an attractive opportunity for powerful investment banks such as Goldman Sachs to cash in on the lucrative deal, which eventually made a handsome $600 million in fees.

To achieve such a feat, Timothy Leissner, a German Banker representing Goldman Sachs in its Asia dealings, enlisted the skills and political connection of a Chinese-Malaysian named Low Teak Jho, also known as “Jho Low” who is currently an international fugitive in hiding, according to media reports.

Leissner would later plead guilty to his role in the scheme.

At first, Goldman’s compliance department had hesitated on bringing Jho Low on board because of the history of his shady dealings, but greed eventually took root. According to the New York Times, U.S. acting Assistant Attorney-General, Brian C. Rabbit stated during a news conference that Goldman’s personnel had intentionally allowed the scheme to proceed by overlooking and ignoring a number of red flags.

Jho Low never held any formal or government position; nevertheless, he was able to engineer the entire scheme to benefit all the players involved. Jho used his powerful connections to pay hundreds of millions in bribes to secure business transactions for 1MDB.

It was reported by BBC that Jho Low purchased a $250 million Mega-Yacht, expensive real estate, and even financed the movie, “The Wolf of Wall Street.”

The irony is not lost since the movie is all about a corrupt wall street broker who defrauds investors in a “pump and dump scheme.” Though it is widely believed that Jho low is currently residing in China, Timothy Leissner, on the other hand, pleaded guilty and agreed to pay back $47.3 million.

PREVIOUS CONTROVERSIES

A protest outside the Goldman Sachs lobby in New York City

History is replete in the lifespan of Goldman Sachs. Over the years, the bank had earned the nickname “The Great Vampire Squid” as it has been tied to several financial scandals and economic events.

According to Rolling Stone, the great Economist, John Kenneth Galbraith, cited the cause of the great depression of 1929 to the Blue Ridge and Shenandoah Trust — which Goldman Sachs had ties to — as an overleveraged investment.

In the mid-2000, Goldman was again right in the middle of the housing bubble. A catastrophe caused by mortgage underwriters lowering the standards to borrowers who in a normal circumstance would not qualify for such loans at very low-interest rates. However, when there’s a shift in the monetary policy and interest rates are tightened, the bubble burst.

Goldman Sachs was notorious for its ability to bundle several toxic assets into its mortgage portfolios, sell them to investors and hedge its bet by taking on insurance policies to protect itself against a burst it might have known was coming.

At every turn of a financial disaster, Goldman can sometimes be found right in the center and waiting for a bailout by the federal government and the insurance companies.

Dennis Kelleher, the chief executive of Better Markets, a financial watchdog, who spoke to New York Times and said the billion-dollar settlements by Goldman Sachs in the 1MDB scandal were meaningless as he did not expect prosecutors to enforce the deferred prosecution agreement.

Even with the 1MDB settlement, Goldman Sachs dodged another bullet by its subsidiary, pleading guilty instead of the corporation. That means the financial giant will continue to operate as the public waits for the company to seemingly find itself in another scandal.

Become a Front Page Detective

Sign up to receive breaking

Front Page Detectives

news and exclusive investigations.